In Transient: SARB Charge Resolution Deepens Shopper Debt Disaster

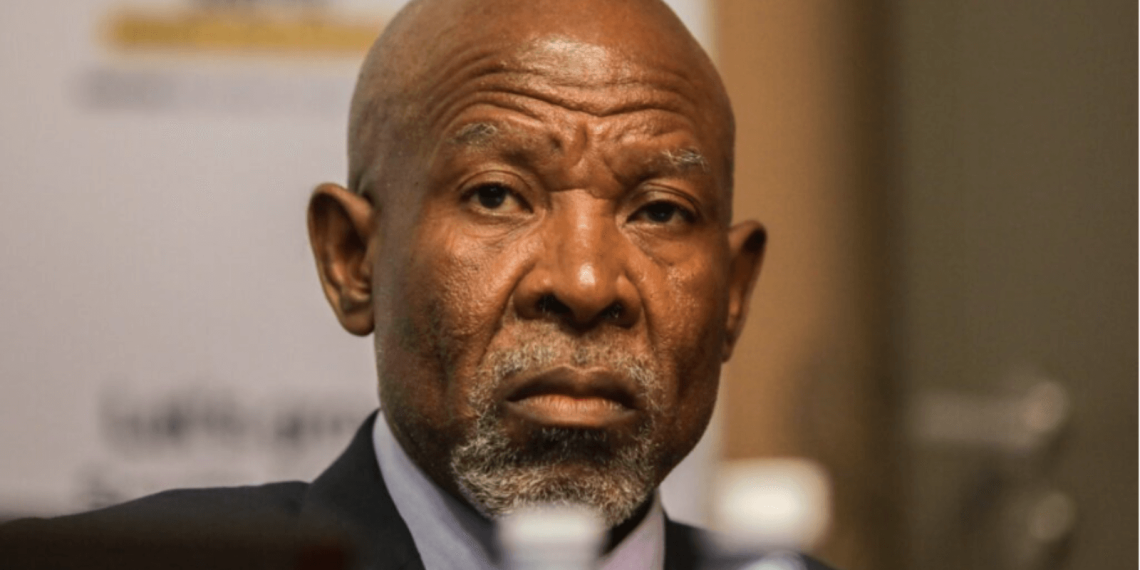

Neil Roets, CEO of Debt Rescue, says the South African Reserve Financial institution’s choice to take care of rates of interest unchanged, mixed with upcoming VAT will increase, unchanged private revenue tax brackets, and a considerable rise in electrical energy tariffs, is putting immense monetary strain on South African customers.

Roets warns that tens of millions of persons are being pushed deeper into monetary hardship as they grapple with file unemployment, hovering dwelling prices, and excessive debt ranges. Shopper debt at the moment stands round R2.3 trillion, forcing many right into a cycle of ongoing debt, particularly relating to massive purchases like properties and automobiles. He recommends that these going through monetary difficulties ought to search help from registered debt counsellors to assist regain management of their funds.

SARB Retains Curiosity Charges Regular, Including to Shopper Struggles

Written by Town Press

South African customers have been dealt one other monetary blow on Thursday because the South African Reserve Financial institution (SARB) determined to maintain the nation’s repurchase charge unchanged, providing no aid amid mounting financial pressures. The choice was made by the central financial institution’s Financial Coverage Committee (MPC), with 4 members voting in favor of sustaining the speed, whereas two supported a 25-basis-point minimize.

Consequently, the repo charge stays at 7.5%, and the prime lending charge stays at 11%. This choice, coupled with an imminent 0.5% VAT enhance for the present monetary 12 months—adopted by one other 0.5% hike in 2026/2027—has dashed hopes for any respite amongst struggling South Africans. In line with Neil Roets, CEO of Debt Rescue, these compounding monetary pressures are pushing tens of millions deeper into despair.

“The federal government has delivered a deadly one-two punch that may decimate the lives of strange residents, who’re already overwhelmed by monetary hardship,” Roets stated.

He emphasised that even a modest charge minimize may have provided a glimmer of hope to embattled customers drowning in debt on account of hovering rates of interest. As a substitute, the VAT enhance, coupled with record-high unemployment and rising prices of important items, is pushing the nation to the brink. Roets additionally criticized the federal government’s failure to regulate private revenue tax brackets in keeping with inflation for the 2025/2026 funds. “This successfully will increase the tax burden on people, as salaries develop however tax thresholds stay static,” he famous. Including to the disaster is the 12.7% electrical energy tariff hike set to take impact on April 1, 2025, additional exacerbating monetary pressure.

“Whatever the international and home financial elements influencing this choice, the influence on taxpayers can be extreme. Fluctuating inflation, rising prices, and a shrinking client buying energy have considerably eroded the usual of dwelling, notably for lower-income households,” Roets said. “It’s unacceptable that hardworking South Africans proceed to bear the brunt of the best rates of interest in over a decade, coupled with relentless dwelling value will increase, an escalating water disaster, and meals costs that make primary vitamin unattainable for probably the most weak,” he added.

South Africans are barely managing to remain afloat, with the typical client now spending 68% of their take-home pay on servicing debt.

“Whole client debt has reached roughly R2.3 trillion, with greater than half of this tied up in dwelling loans,” Roets revealed, citing information from the Nationwide Credit score Regulator (NCR). He famous that mortgage purposes and arrears hit file highs in Q3 2024, with mortgage arrears climbing to six.9% of excellent loans. Funds overdue by one to a few months additionally stay alarmingly excessive.

“The rising value of credit score retains many trapped in a vicious debt cycle, notably for large purchases like properties and automobiles,” Roets defined. “For these struggling to interrupt free from monetary misery, in search of assist from a registered debt counselor is a confirmed resolution. 1000’s have efficiently regained management over their funds by way of structured debt aid applications.”

Read the Townpress Newspaper Article