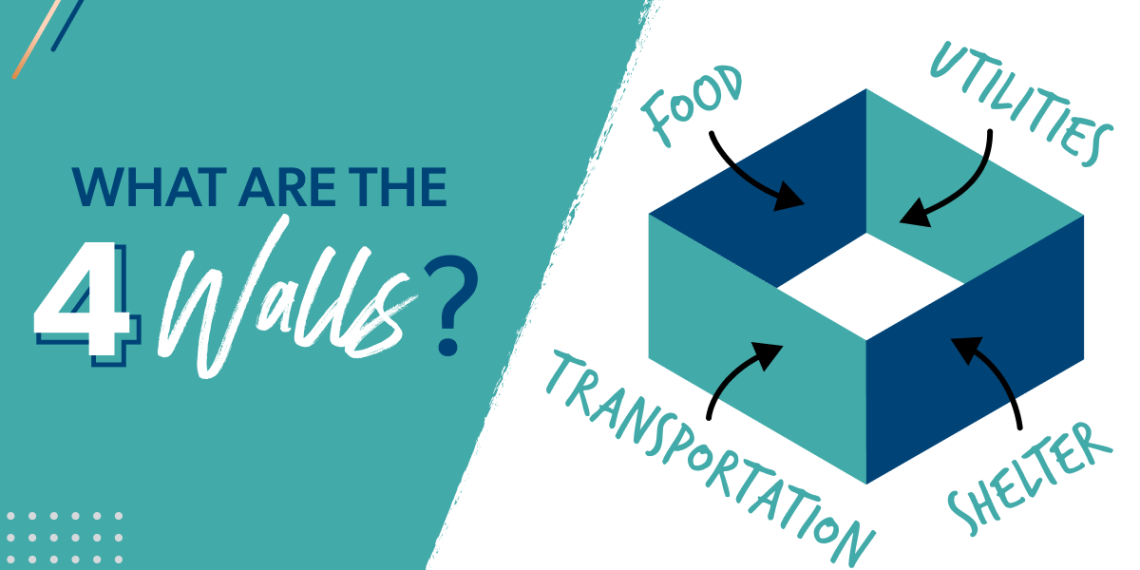

For over a decade, I’ve been educating folks all about budgeting—so you understand I’ve been requested sure questions many times. Truthfully, a ton of these are about the way to get began or what to do should you’re immediately in disaster mode. Properly, the reply to each of these questions comes right down to protecting the 4 Partitions.

What are the 4 Partitions? Let’s discover out.

What Are the 4 Partitions of a Funds?

Merely put, the 4 Partitions are probably the most fundamental bills you’ll want to cowl to maintain your loved ones going: That’s meals, utilities, shelter and transportation.

Meals

After I say meals is without doubt one of the 4 Partitions, I want you to listen to this loud and clear: Groceries are important—eating places aren’t. That is coming from somebody who loves going out to eat and even grabbing some Chick-fil-A for the household on the best way house. However that scrumptious hen is a luxurious. Going out to my favourite Mexican restaurant on date evening with Winston is a luxurious.

Ensure there’s room within the budget for groceries (and different wants) earlier than you make room for the luxuries!

Utilities

Subsequent up are utilities, aka the bills that maintain your own home working. Listed here are a few of the commonest ones:

- Electrical energy

- Water

- Pure gasoline or propane

- Trash companies

- Fundamental cellphone invoice

One factor to notice with utility bills is that they usually change from month to month. As you write in a deliberate quantity, price range on the upper facet. If the invoice’s decrease, you possibly can throw the additional cash at your present Baby Step (which is the confirmed plan for saving cash, getting out of debt, and constructing true wealth).

Shelter

“Shelter” means paying for lease or your mortgage (plus insurance coverage, property taxes and HOA charges). A very good rule of thumb right here is to ensure you don’t spend greater than 25% of your take-home pay on this a part of the price range. That helps you retain from turning one in every of your largest blessings (your private home) right into a monetary burden.

Transportation

The transportation price range class can embrace gas, public transportation, routine upkeep—no matter it prices so that you can get the place you’ll want to go that month.

Contained in the 4 Partitions, this wouldn’t embrace aircraft tickets to Disney. When you’re debt-free and wish that dream trip, save up cash in a sinking fund every month and pay money for that journey. However similar to eating places, Disney is not a necessity!

When Do I Use the 4 Partitions?

The brief reply to that query is on a regular basis. The 4 Partitions have a particular place on the prime of your monthly expenses in each month-to-month price range.

However until you’re on the market educating budgeting like I do, you most likely received’t be pondering concerning the 4 Partitions on a regular basis. Listed here are the primary two occasions when you need to, although:

1. While you’re in a monetary emergency

When you’re ever in an emergency scenario (like job loss)—first off, keep in mind, you shall be okay.

Then get your self on a naked bones price range, a making the 4 Partitions your prime precedence. Which means you concentrate on feeding your loved ones, conserving the lights on, paying the lease or mortgage, and getting gasoline within the automotive. It will show you how to maintain afloat financially when you get again in your ft.

2. While you make a price range

The 4 Partitions show you how to set up your monthly budget. You begin off your price range by itemizing your earnings. Then you definitely make room for giving and saving (relying on what Child Step you’re on). After that, you cowl the bills—beginning with (you most likely guessed it) the 4 Partitions!

Start budgeting with EveryDollar today!

Then is available in different requirements (like insurance coverage, debt and childcare). And then the enjoyable stuff (like private spending, leisure and eating places).

While you consider the 4 Partitions as the beginning of all these bills, it helps you kind out your wants versus your desires and maintain your price range priorities so as.

what else may help? EveryDollar. That is the budgeting app my household makes use of each single month to ensure we’re protecting our bills and conserving our spending in step with all our cash targets! You can begin utilizing EveryDollar. As we speak. Without spending a dime.

So, get your free EveryDollar budget—and get your priorities so as. Actually.