Vacation scams have change into tougher to identify than ever, particularly with the rise of AI in 2025. Although the vacation season is probably the most fantastic time of the 12 months, it is usually the time when fraudsters and cybercriminals are most energetic.

Inboxes are flooded with “flash gross sales” and “last-minute offers,” and AI is now being exploited to create threats that look startlingly actual, from pretend supply texts (smishing) to stylish voice-cloning charity fraud. It’s getting more durable to differentiate a real discount from a entice, and one improper click on can simply flip vacation cheer right into a monetary catastrophe.

That can assist you keep protected, American Shopper Credit score Counseling created this information to interrupt down six important methods to guard your pockets from vacation scams in 2025.

Key Takeaways:

- Spot the Large Scams: in 2025: Phishing emails, pretend on-line shops, present card cost scams, charity fraud, AI-generated impersonation scams, and pretend supply or missed packages notices.

- Defend your accounts: Use sturdy, distinctive passwords and think about a password supervisor. Allow two-factor authentication (2FA) for added safety. Safe your Wi-Fi community and use a VPN when on public Wi-Fi.

- Confirm Earlier than You Purchase: If a deal appears too good to be true, it most likely is. Confirm the retailer’s fame earlier than you click on “Purchase.”

- Pay with safety: At all times use a bank card as an alternative of utilizing a debit card or wire transfers. Bank cards normally provide stronger fraud safety in the event you do get scammed.

- Monitor & React: Arrange transaction alerts and verify your statements weekly. Should you spot fraud, report it instantly to your financial institution and the FTC, and think about inserting a fraud alert in your credit score report.

6 methods to Defend Your Pockets from Vacation Scams in 2025

1. Acknowledge the “5 Large” vacation scams in 2025

In accordance with the 2024 FBI Internet Crime Report, there have been 193,407 Phishing/Spoofing complaints, leading to customers dropping a complete of $70,013,036. Subsequently, realizing what to search for is the most effective protection towards the 5 massive vacation scams in 2025.

Rip-off Sort |

How It Works |

The Crimson Flag |

|---|---|---|

| Phishing Emails | Emails mimicking retailers (e.g., Amazon, FedEx) with hyperlinks to steal knowledge. | Sender tackle has typos (e.g., assist@amaz0n.com). |

| Pretend On-line Shops | Fraudulent websites copying actual manufacturers to steal bank card information. | Costs are unrealistically low; the location lacks critiques. |

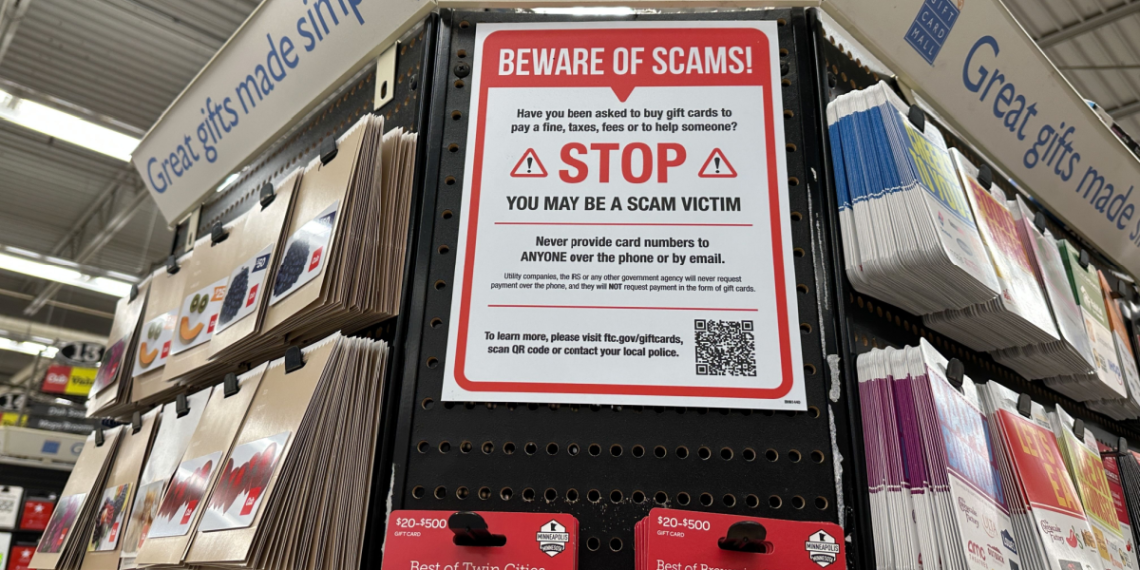

| Reward Card Fraud | Vendor calls for cost by way of present card (Apple, Google Play, and so forth.). | No respectable enterprise ever asks for cost by way of present card. |

| Charity Scams | Pretend organizations are exploiting vacation generosity. | The charity identify sounds much like an actual one, but it surely isn’t on Charity Navigator. |

| Non-Supply Scams | You purchase a product that by no means arrives, or promote one and by no means receives a commission. | Vendor refuses to make use of safe platforms (like PayPal Items & Companies). |

2 . Strengthen your on-line safety

As famous by The New York Occasions Wirecutter, “When you’re updating your passwords, activate two-factor authentication for on-line accounts that assist it. Enabling this function, together with a novel password, makes your on-line accounts a lot more durable for strangers to entry and provides just a few seconds to your routine.”

Right here’s how one can strengthen your on-line safety

- Use a password supervisor: Use a password supervisor to generate complicated and distinctive passwords for every of your accounts. By no means use the identical password on two accounts. Use a password supervisor to securely retailer them.

- Allow Two-Issue Authentication (2FA): Add it each time it’s obtainable for an additional layer of safety. This requires a second type of verification, equivalent to a textual content message code, along with your password.

- Safe Your Wi-Fi Community: Guarantee your own home Wi-Fi community is password-protected and use a Digital Non-public Community (VPN) when accessing public Wi-Fi to encrypt your knowledge.

3. Store sensible, Store protected

As you hunt for the most effective offers, maintain security on the forefront:

- Confirm Offers and Reductions: If a deal appears too good to be true, it most likely is. Examine costs and verify the retailer’s fame earlier than making a purchase order.

- Use credit score over debit: Bank cards provide stronger fraud safety and simpler dispute decision than debit playing cards. Many bank cards additionally provide zero legal responsibility for unauthorized purchases.

- Keep away from Public Wi-Fi for Transactions: Keep away from procuring on public Wi-Fi networks with no VPN. Should you should store, use cell knowledge to make purchases reasonably than public Wi-Fi.

4. Monitor your monetary accounts repeatedly

Don’t wait till your month-to-month statements to verify unauthorized transactions. Make it a behavior to maintain observe of your accounts regularly.

- Assessment pending expenses on accounts – Scammers usually take a look at a card with small expenses (underneath $5) earlier than making a big buy. Report these instantly.

- Set Up Alerts: Most banks and bank card corporations provide alerts for big transactions or uncommon spending patterns. Allow these alerts to remain knowledgeable of exercise in your accounts.

5. Educate your self and family members

Scammers usually goal susceptible demographics as a result of they’re simpler to succeed in and fewer tech-savvy.

- Keep Knowledgeable: Maintain updated with the most recent scams by following shopper safety web sites and information shops.

- Educate Household Members: Focus on frequent scams and security measures with household, particularly those that could also be extra susceptible, equivalent to aged family or younger adults new to managing their funds.

- For instance, educate younger adults and college students learn how to establish a safe checkout URL (https:// and the padlock icon). Warn aged family about AI voice scams that will sound like a grandchild in misery.

- Use Trusted Assets: As a substitute of counting on social media for monetary recommendation, encourage members of the family to discover nonprofit organizations equivalent to American Shopper Credit score Counseling for verified guides on protected spending and credit score administration.

6. Motion Plan: What ought to I do if I fall for a rip-off?

Right here’s what to do if in case you have been focused.

- Report the Rip-off: Contact your financial institution or bank card firm instantly to report unauthorized transactions. They can assist you safe your accounts and doubtlessly get better misplaced funds.

- File a federal Criticism: Report the rip-off to the Federal Trade Commission (FTC). This helps authorities observe scams and forestall others from falling sufferer to them.

- Monitor Your Credit score: Contemplate inserting a fraud alert in your credit score report and repeatedly reviewing it for uncommon exercise. This can assist forestall identification theft.

- Assess the Monetary Injury: If a rip-off has drained your checking account or maxed out your bank card, don’t panic. Attain out to a nonprofit like ACCC for a [to help prioritize your remaining bills and avoid falling into a debt cycle while the bank investigates.

Secure Your Finances in 2025

Protecting your wallet this holiday season requires more than hope; it requires action. By treating every unsolicited message with skepticism and locking down your accounts with 2FA and strong passwords, you can stop scammers before they strike.

Remember: If a deal looks too good to be true, it is. Don’t let the pressure of “last-minute 2025 deals” cloud your judgment.

Need Help Managing Holiday Debt? If you are feeling overwhelmed by holiday expenses or are recovering from a financial setback, you don’t have to navigate it alone. American Consumer Credit Counseling (ACCC) is here to help you regain control.

Frequently Asked Questions

Q: What are the most common holiday scams I should be aware of?

A: The most common holiday scams in 2025 include AI-generated phishing emails, fake delivery texts (smishing), and QR code fraud (quishing). 2025 has seen a rise in “quishing”—where scammers paste fake QR codes over real ones on parking meters or mailers to steal payment data. Be wary of any text message claiming a “delivery delay” that asks you to click a link.

Q: Is it safe to buy items directly from social media ads?

A: It is risky; scammers often use AI to create fake storefronts on social platforms that vanish after collecting payments. Instead of clicking “Buy Now” on Instagram or TikTok, open a new browser tab and search for the retailer directly. If the store doesn’t exist outside of social media, or if the prices are 80-90% off, it is likely a scam.

Q: What should I do if I suspect I’ve fallen for a scam?

A: If you suspect you’ve fallen for a scam, immediately report it to your bank or credit card company, file a complaint with the Federal Trade Commission (FTC), and monitor your credit and bank statements for any unusual activity.

Q: What’s the safest way to pay for holiday shopping online?

A: Credit cards are the safest option because they offer federally mandated fraud protection (Zero Liability). Avoid using debit cards and wire transfers. Also, try to avoid making direct peer-to-peer payments (like Zelle or Cash App) for retail purchases. If you are scammed using these methods, it is nearly impossible to get your money back.

Q: How can you tell if an online retailer or charity is fake?

A: Check their URL for inconsistencies such as misspellings. (Ex: Amaz0n.com) For charities, research them thoroughly on sites like Charity Navigator or GuideStar to ensure they are legitimate before donating.

Q: How can I strengthen my online security during the holiday season?

A: Strengthen your online security by using strong and unique passwords for each account, enabling two-factor authentication whenever possible, securing your Wi-Fi network, and using a VPN when accessing public Wi-Fi.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.