Feeling overwhelmed by cash issues? You’re not alone. With U.S. family debt reaching $ 18.20 trillion {dollars}1, monetary stress is affecting extra Individuals than ever earlier than. Almost 50% of adults report feeling pressured or anxious about their monetary state of affairs, in accordance with a 2024 survey from Motley Idiot Cash.

Key Perception

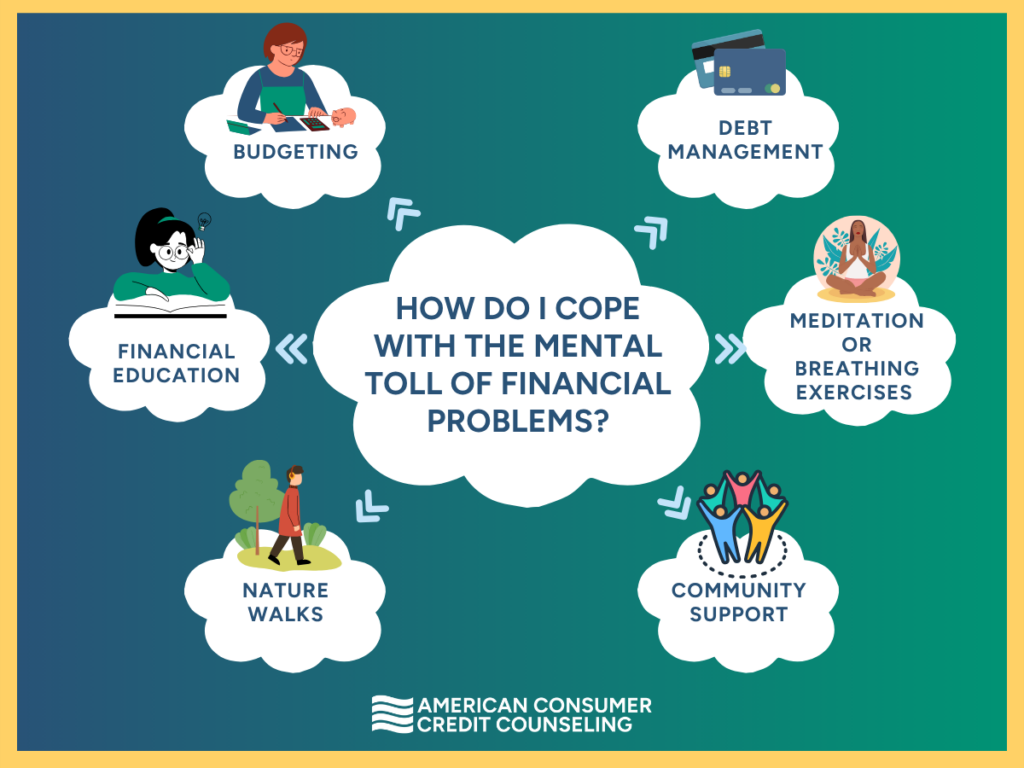

Dealing with the psychological toll of monetary issues entails a mixture of monetary methods (like budgeting and debt administration) and emotional instruments (comparable to meditation, neighborhood assist, and bodily exercise). Looking for skilled assist each monetary and psychological could make a major distinction.

For info on debt administration applications, contact ACCC.

Understanding the Psychological Impression of Monetary Stress

Monetary stress can manifest in varied methods, affecting each mental and physical health. Widespread signs embrace fixed fear, sleep disturbances, irritability, and problem concentrating. Over time, these points can result in extra severe psychological well being issues comparable to anxiousness problems or melancholy. Recognizing these indicators early and taking proactive steps to handle them is essential for sustaining general well-being.

Please do not forget that these responses are frequent and that there isn’t a disgrace in in search of assist to alleviate the burden.

Can Monetary Points Impression My Relationships?

Sure, the psychological burden of monetary stress can considerably pressure your relationships, usually leading to arguments. It could additionally result in diminished communication, as people may really feel embarrassed or overwhelmed by their monetary circumstances. Moreover, restricted funds for social occasions may cause individuals to withdraw from their family members, isolating themselves as an alternative of reaching out. This lack of communication can additional exacerbate emotions of isolation and helplessness.

How Monetary Stress Impacts Bodily Well being

Unchecked monetary stress may also manifest in bodily well being. The BetterHelp Editorial Crew and Nikki Ciletti notice that,

“Like many different varieties of stress, monetary stress can result in bodily well being points. Individuals experiencing stress may need complications and migraines or digestive issues like abdomen cramps, bloating, and irritable bowel syndrome (IBS). Continual stress can contribute to persistent muscle stress and ache, insomnia, poor-quality sleep, or hypertension.”3

It’s essential to acknowledge these indicators early and deal with them proactively. Taking small, manageable steps to enhance your monetary state of affairs can alleviate stress and promote general well-being.

Bear in mind, taking good care of your monetary well being is a vital part of sustaining a balanced and wholesome life.

What are A few of the Coping Methods For Monetary Stress

To successfully handle the psychological influence of monetary stress, it’s important to mix sensible monetary methods with emotional coping methods. Listed below are some actionable steps you may take:

Get Lively, Drawback Fixing:

- Monetary Schooling: Gaining a greater understanding of non-public finance can empower you to make knowledgeable choices and cut back anxiousness. Take into account taking free on-line programs, attending workshops, webinars, or studying books on budgeting, saving, and investing. Data is a strong instrument in regaining management over your monetary state of affairs. Don’t know the place to begin? Verify in along with your native library for books and upcoming neighborhood courses.

- Budgeting: Creating an in depth funds will help you acquire readability over your funds. Record your earnings, bills, and money owed to determine areas the place you may in the reduction of and allocate funds extra successfully. A well-structured funds offers a roadmap for managing bills and lowering debt, assuaging a few of the monetary stress. Make it a behavior to usually assessment and alter your funds; it needs to be versatile sufficient to accommodate the modifications in your life.

- Debt Administration: When you’re scuffling with credit card debt, take into account reaching out to a nonprofit credit score counseling company like American Consumer Credit Counseling (ACCC). They will help you create a personalised debt administration plan that consolidates your money owed right into a single month-to-month cost, usually with diminished rates of interest. This strategy simplifies the reimbursement course of and might relieve monetary strain. Having a technique to get rid of your debt can alleviate stress and anxiousness, because it lets you visualize the end line forward.

Emotional and Psychological Coping Methods

- Mindfulness and Meditation: Incorporating mindfulness practices, comparable to meditation or deep respiratory workout routines, into your day by day routine will help cut back stress and enhance psychological readability. These methods encourage leisure and supply a psychological break from monetary worries, permitting you to strategy challenges with a calmer mindset.

- Bodily Exercise: Participating in common bodily exercise, whether or not it’s yoga, a brisk stroll, jog, or a exercise session, can have a constructive influence in your psychological well being. Train releases endorphins, which act as pure temper lifters, serving to to scale back stress and anxiousness.

- Neighborhood Assist: Becoming a member of neighborhood teams or assist networks can provide a way of connection and understanding. Sharing experiences and options with others dealing with comparable challenges can present emotional aid and sensible recommendation. Take into account collaborating in on-line boards or native meetups targeted on monetary wellness and psychological well being.

- Nature Walks: Spending time in nature has been proven to scale back stress and promote leisure. Taking common walks in a park or pure setting can present a peaceable respite from monetary issues, serving to you to reset and recharge.

What if I nonetheless really feel the psychological toll of monetary issues? Search skilled assist.

If monetary stress turns into overwhelming, don’t hesitate to hunt skilled assist. Psychological well being professionals, comparable to therapists or counselors, can present steerage and assist tailor-made to your state of affairs. They will help you develop coping methods and work by any emotional obstacles associated to monetary stress.

Key Takeaways

Dealing with the psychological toll of monetary issues requires a balanced strategy that addresses each monetary and emotional elements. By combining sensible monetary methods with psychological well being practices, you may cut back stress and anxiousness, enhancing your general well-being. Bear in mind, it’s essential to take one step at a time and search assist when wanted, figuring out that you just’re not alone in your journey towards monetary stability and peace of thoughts. Managing monetary stress is a journey, not a vacation spot. Be affected person with your self and acknowledge that progress takes time. If you end up struggling, don’t hesitate to succeed in out for skilled assist—each monetary and emotional—to information you in your path to restoration.

Often Requested Questions

Can monetary stress trigger well being issues?

Sure. Continual monetary stress can result in bodily situations like hypertension, insomnia, and digestive points.

Is monetary anxiousness frequent?

Very. Surveys present that about 1 in 2 Individuals really feel anxiousness associated to their monetary state of affairs.

What’s a debt administration plan?

It’s a structured reimbursement plan—supplied by nonprofit businesses like ACCC—that helps you pay down unsecured debt by one month-to-month cost, usually at a decrease rate of interest.

When you’re struggling to repay debt, ACCC will help. Schedule a free credit counseling session with us in the present day.

Sources: