For a lot of South Africans, January feels countless. The mix of December overspending, school-related prices, rising meals costs and ongoing debt repayments leaves households feeling caught earlier than the 12 months has even begun correctly.

If you happen to’re coming into February feeling financially drained, anxious or behind, it’s necessary to know this: Januworry doesn’t outline your total 12 months. Monetary restoration continues to be doable and for a lot of, February is when readability lastly returns.

Throughout South Africa, 1000’s of customers solely realise they’re over-indebted after January ends. This doesn’t imply you’ve failed. It means your bills have outpaced your revenue, a actuality confronted by many households within the present financial local weather.

Why Januworry Hits So Arduous in South Africa

Januworry is structural, not simply emotional. Most households face:

- A full 12 months of collected credit score stress

- Deferred December bills touchdown directly

- Decreased disposable revenue resulting from rising residing prices

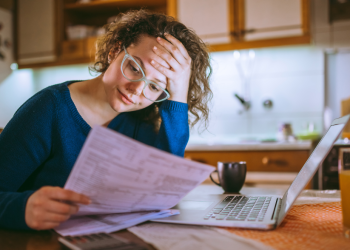

By February, many individuals are nonetheless juggling arrears, maxed-out bank cards or a number of debit orders. That is typically when customers start looking for debt counselling South Africa, debt assist or info on debt overview South Africa.

What Monetary Restoration Can Look Like After January

Recovering financially doesn’t require a drastic in a single day change. It begins with understanding your place clearly. This may increasingly embrace:

- Reviewing your whole debt obligations

- Understanding how a lot of your revenue goes towards repayments

- Figuring out whether or not your debt continues to be manageable or has turn into unmanageable

For customers who’re over-indebted, debt counselling gives skilled steering on obtainable debt options, together with whether or not debt overview could also be acceptable. Debt counselling is about readability and sensible planning below the framework of the Nationwide Credit score Act.

How Debt Counselling Can Assist You Regain Management

When debt turns into unmanageable, debt counselling helps you:

- Assess affordability precisely

- Discover lawful debt administration choices

- Perceive how debt overview works in South Africa

- Defend important property whereas repayments are restructured

For qualifying customers, debt overview restructures repayments into one inexpensive quantity and supplies authorized safety from collectors when you work towards stability. You may study extra about how the method works here.

The Remainder of the 12 months Is Nonetheless Open

February is to not make amends for all the pieces directly. The cycle first must be stopped early sufficient in order that the remainder of the 12 months can enhance. Many customers who search debt counselling assist in February:

- Regain cash-flow stability by mid-year

- Cut back stress and monetary uncertainty

- Keep away from deeper arrears later within the 12 months

If you happen to’re uncertain the place you stand, a free evaluation may also help you perceive your choices with out obligation. Use the free debt assessment calculator.