Meals and shelter proceed to drive inflation

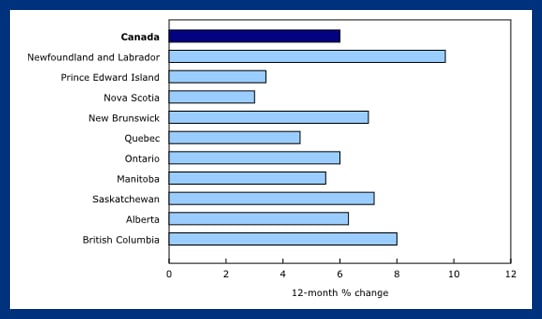

Whereas falling gasoline costs led to a average 1.6% annual inflation fee in September, Statistics Canada revealed that October’s annual inflation fee had ticked again as much as 2%.

Despite the fact that fuel costs proceed to fall, meals and shelter make up such a lot of what Canadians spend, they dominate the general inflation image. Shelter makes up 28.6% of what Canadians spend, and meals has now elevated to 16.7%. Consequently, whereas gadgets like clothes and transportation aren’t actually going up, meals and shelter pull up the annualized common to 2%. The inflation fee for shelter is coming down slowly, however it continues to be a ache level for a lot of Canadians.

| CPI tems | September 2024 | October 2024 |

|---|---|---|

| All | 1.6% | 2.0% |

| Meals | 2.8% | 3.0% |

| Shelter | 5.0% | 4.8% |

| Family operations, furnishings and tools | -0.2% | -0.1% |

| Clothes and footwear | -4.4% | -2.3% |

| Transportation | -1.5% | 0.2% |

| Well being and private care | 3.1% | 3.1% |

| Recreation, schooling and studying | 0.0% | -0.9% |

| Alcoholic drinks, tobacco merchandise and leisure hashish | 3.0% | 3.0% |

Whereas costs for providers rose at an annual fee of three.6% in October, costs for items have been up simply 0.1%. (Usually talking, service would come with gadgets comparable to haircuts, housekeeping providers, or dental care. Items can be all the pieces from TVs to sneakers.) Property tax will increase are all the time a spotlight of the October inflation report, since that’s when they’re recalculated annually. This 12 months, property taxes rose 6% (in comparison with a 4.9% enhance final 12 months).

This inflation enhance goes to make it tougher for the Financial institution of Canada (BoC) to justify giant rate of interest cuts going ahead. If inflation stays stubbornly excessive, we may even see the BoC cut back on its forecasted rate of interest cuts. Given the U.S. election outcomes that we commented on last week, “increased for longer” rates of interest might very nicely be the brand new possible path ahead.

Canada’s greatest dividend shares

Lacking the Goal

One of many greatest surprises on Wall Road this week was the huge earnings miss by Goal. Shares have been down 21% on Wednesday after Goal revealed it’s having issue producing gross sales income regardless of a heavy discounting technique.

American retailer earnings highlights

It’s been an enormous week for large U.S. company retailers. All numbers beneath are in U.S. {dollars}.

- Walmart (WMT/NYSE): Earnings per share of $0.58 (versus $0.53 predicted). Income of $169.59 billion (versus $167.72 billion predicted).

- Goal (TGT/NYSE): Earnings per share of $1.85 (versus $2.30 predicted). Income of $25.45 billion (versus $25.21 billion estimate).

- Lowe’s (LOW/NYSE): Earnings per share of $2.89 (versus $2.82 predicted), and revenues of $23.59 billion (versus $23.91 billion predicted).

Goal CEO Brian Cornell blamed the dangerous quarter on “lingering softness in discretionary classes,” in addition to poor stock administration. Goal incurred increased shipping costs because it paid excessive charges to hurry items into its warehouses forward of the port strike in October. These prices, mixed with flatlining demand, led to a expensive stock build-up. Shares at the moment are at a 52-week low.

In stark distinction to the big earnings miss by Goal, its massive blue competitor continued to point out why it’s best-in-class. Walmart beat earnings—but once more—and confirmed the monetary consistency that buyers love. Apart from higher stock administration, the most important purpose for Walmart’s increased gross sales numbers possible relate to the totally different product mixes of the 2 retailers. At this level, Walmart is a large grocery retailer with a big everything-else-store connected, as 60% of Walmart’s U.S. enterprise is groceries (whereas solely 23% of Goal’s gross sales are groceries).

Whereas on-line gross sales have been up 10% for Goal, they have been up 22% for Walmart. Walmart Chief Monetary Officer John David Rainey acknowledged that prospects continued to be “centered on value and worth.” He added that tariffs might pressure Walmart to extend costs, however that it was too quickly to say what merchandise would really feel the tariff pinch the toughest.

Shares of Lowe’s dropped about 3% on Tuesday when it introduced an earnings beat, however a slight miss on revenues. CEO Marvin Ellison mentioned that administration believes prospects are delaying dwelling enchancment tasks till charges have completed coming down. They anticipate gross sales to choose up in 2025.