So, perhaps you’ve obtained an irregular revenue—that means you don’t make the identical sum of money each paycheck. If that’s you, you aren’t alone. Loads of individuals work hourly or commission-based jobs or have facet gigs that change up their revenue each month.

However you possibly can—and may—finances each month, irregular revenue or not. It takes a little bit getting used to, nevertheless it isn’t laborious in the event you observe these six steps.

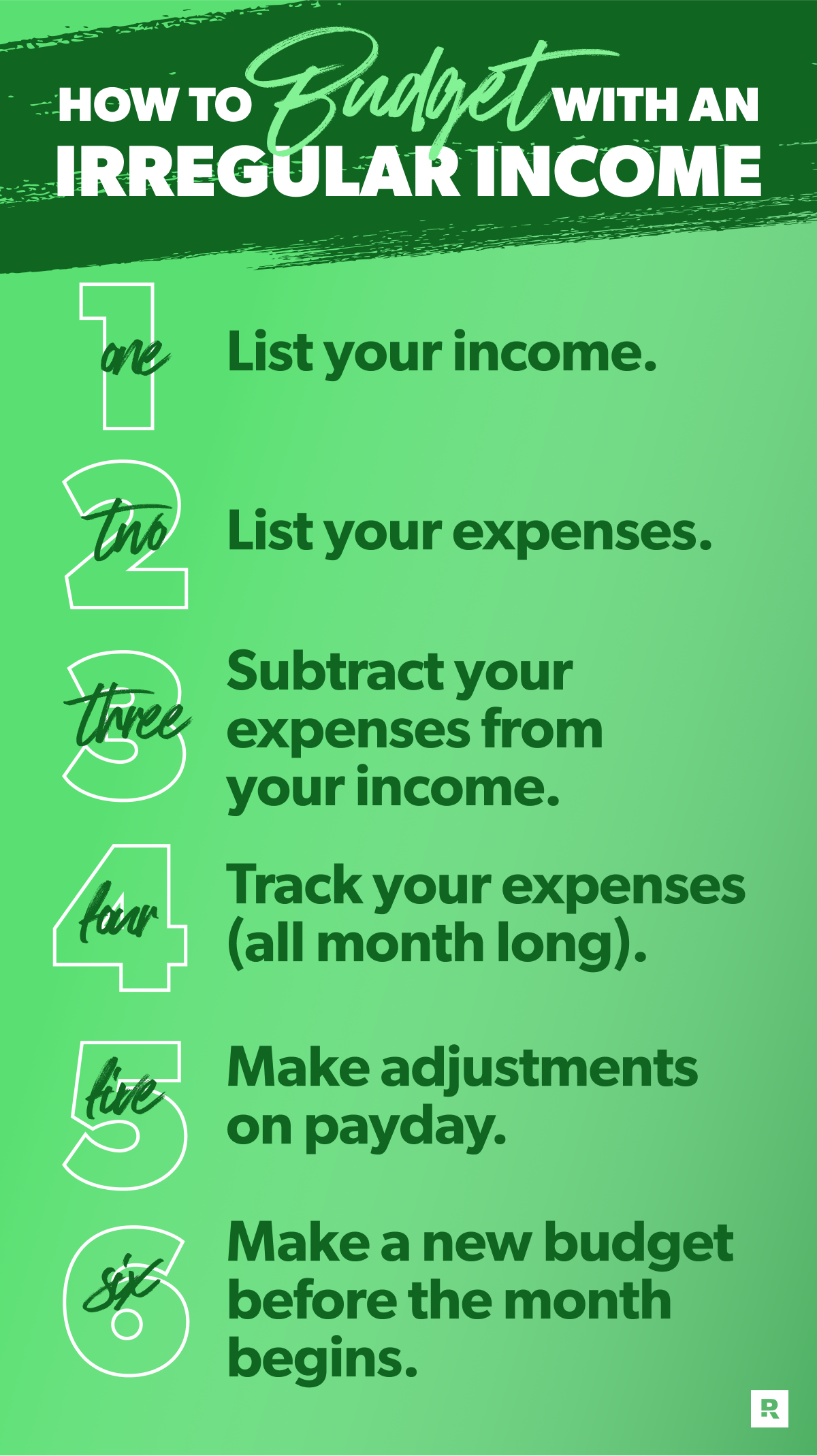

1. Listing your revenue.

For those who’ve obtained an irregular revenue, plan low. That’s proper—it’s best to arrange your budget primarily based in your lowest month-to-month revenue estimate.

It’s manner higher to begin low than to begin with a median. Why? As a result of in the event you finances low, you possibly can all the time go up from there. However guessing excessive and having to again off later—that’s spells bother. (Not actually, after all.)

To seek out your place to begin, look again at some previous pay stubs. What’s the lowest you’ve made in the previous few months? Go together with that.

If that is your first time engaged on fee or dwelling on an irregular revenue, don’t fear! For now, estimate what your lowest month will appear to be. And put that in as your revenue.

By the best way, if you wish to begin off utilizing pencil and paper, try our Irregular Income Budget Planning type! It might probably actually assist to jot down out and see these numbers in black and white (or no matter colour ink you employ).

However then, we predict it’s best to improve your expertise by downloading EveryDollar, our free budgeting app. As a result of pay attention, making—and preserving—a month-to-month finances is manner simpler with EveryDollar. Simply saying.

2. Listing your bills.

Okay, when you’ve deliberate for all the cash coming in, it’s time to prep for all the cash going out. That’s proper, it’s time to record your bills.

Now, earlier than you dive into the payments and the whole lot else, put aside cash for giving. We consider in giving 10% of your revenue to your church or a charity. And in the event you don’t have an emergency fund but, make financial savings your subsequent precedence.

After that, deal with masking what we name the Four Walls: meals, utilities, shelter and transportation. Then, finances for all of your different month-to-month bills. Begin with the necessities, like insurance coverage, debt and childcare.

Lastly, give your self a miscellaneous line and finances for nonessentials, like TV streaming services, eating places, grownup kickball league charges, subscription containers and private spending.

However bear in mind—when you have an irregular revenue, chances are you’ll not have the ability to take pleasure in sure extras each month.

For instance, when you have a month of lower income, which may imply it’s important to cut spending in locations like your leisure class. Perhaps this month, you’re renting a film and getting frozen pizzas to eat at dwelling as an alternative of going out for dinner and a film (which truly sounds very nice anyway).

Hey, it’s important to cowl your wants earlier than your desires. Interval. However you’ve obtained this.

Let’s recap the heavy hitter right here: You may need to skip a few of the extras (or plan low) at first. But when your revenue finally ends up greater than what you’ve deliberate—effectively, Step 5 covers that! (However don’t skip forward. Hold studying!)

Additionally, we wish to name out a premium feature in EveryDollar actual fast. It’s name paycheck planning, and it’s made for irregular incomes. It helps you arrange your bills primarily based on once they’re due and lets you realize whenever you’re liable to overspending all through the month!

3. Subtract your bills out of your revenue.

This quantity ought to equal zero, which is why we name it zero-based budgeting.

Okay, be sure you perceive that the zero right here doesn’t imply you let your checking account attain zero. Ever. Depart a little bit buffer in there of about $100 to $300.

Start budgeting with EveryDollar today!

So, why zero? A zero-based finances is our absolute favourite budgeting technique as a result of it’s all about giving each greenback a job—whether or not that’s giving, saving, paying off debt, or spending. Each greenback that is available in has a goal that you assign it! As a result of {dollars} with out jobs get spent by chance on impulse buys and senseless, each day espresso runs.

Keep in mind, spending isn’t unhealthy. However spending with out goal will hold your monetary objectives miles out of attain. Endlessly.

Let’s discuss some logistics right here, although. What in the event you subtract your bills out of your revenue and also you’ve obtained cash left over? Um, give your self a excessive 5. (Is that simply clapping?) After which put these {dollars} to work by placing any “further” cash towards your present money goal.

What if you find yourself with a unfavourable quantity? That is truly fairly doubtless in the event you’ve obtained an irregular revenue. You’re budgeting low, bear in mind? Nevertheless it’s okay in case your numbers are off. You simply want to chop the extras (at the very least for now) till your revenue minus your bills equals zero.

4. Observe your bills (all month lengthy).

Wish to know what one of many greatest secrets and techniques to budgeting effectively is? We received’t maintain again. Not even for a second. Right here it’s: Track. Your. Expenses.

What does that imply? If you spend cash on one thing, you subtract that quantity from its finances line. That manner you all the time understand how a lot cash you may have left to spend. And that retains you from overspending.

If you earn a living, add that to your deliberate revenue for the month. That is extremely vital when you have an irregular revenue, as a result of monitoring your revenue will present you in the event you made as a lot as you deliberate or not.

And hopefully, you made extra than you deliberate. Who doesn’t find it irresistible when that occurs? We’ll discuss within the subsequent step about what to do when you may have extra cash to finances, however first we wish to make certain we’ve coated all of the bases about why it’s important to monitor bills.

Budgeting is planning the place your cash will go. Monitoring bills exhibits you the place the cash did go. Monitoring bills holds you accountable—to your self!

So monitor these bills. Each single one.

5. Make changes on payday.

The important thing to profitable with budgeting on an irregular revenue is being versatile and staying on prime of it. One of many methods you do that’s by adjusting your finances as you receives a commission.

In case your revenue finally ends up being greater than you deliberate, be sure you give your self these awkward excessive fives we talked about earlier. Then, add the additional revenue to your finances.

So, in the event you set your month-to-month revenue to $4,500 however truly made $5,000, return and add that further $500 in as revenue.

Then what?

Effectively, you continue to desire a zero-based finances. And also you had one, till that pretty further $500 got here in. (Good downside to have, proper?)

Time to place that cash to work! You may add it to your present Baby Step (aka the confirmed plan to saving, paying off debt, and constructing wealth).

Additionally, you would possibly return to a kind of extras you reduce on or skipped whenever you first made your finances and provides it some monetary love.

6. Make a brand new finances (earlier than the month begins).

Yay! You made a finances, and now you by no means must make one other one once more, proper?

Effectively, no. A finances isn’t a sluggish cooker. You don’t set it as soon as and overlook it. You’ve obtained to get in there and monitor these bills. You’ve obtained to make changes alongside the best way.

And also you’ve obtained to make a brand new finances each single month! It’s extra like a unbelievable progressive dinner or five-course meal. It takes effort and time however is tremendous value it.

Your finances doesn’t change that a lot month to month—nevertheless it’s not ever 100% the identical. So, copy over this month’s finances for the subsequent, after which tweak as it’s essential. Meaning including in month-specific expenses, like your BFF’s birthday or that oil change you want.

And all the time make your finances earlier than the month begins so that you’re forward of your cash, not lagging behind.

You Can Finances (and Do It Effectively!) With an Irregular Revenue

Keep in mind, something value profitable takes work. So, if you wish to win with cash—you’ll must work at it. It often takes round three months to get snug with budgeting, irrespective of your revenue. So, hold going. You actually can do that.

However we’ll be trustworthy: It’s manner simpler to finances effectively whenever you’ve obtained a budgeting software. And it’s manner, manner simpler when that software is cellular and was created particularly that can assist you tackle these Child Steps.

That’s EveryDollar. Obtain it at the moment so you can begin budgeting higher and crushing your cash objectives even faster.