It doesn’t matter what you wish to do together with your cash, it begins with a price range. As a result of a budget is a plan to your cash—you inform it the place to go, so that you cease questioning the place the heck it went.

However if you happen to’ve by no means budgeted earlier than, or it’s been some time, leaping in might be difficult. what may also help? A price range template!

There’s nothing like having clear instructions to comply with and step-by-step blanks to fill in to provide the confidence you might want to get occurring this budgeting journey. You prepared? (Sure, you might be.)

Steps for Utilizing Your Funds Template

A price range template (or price range worksheet) is a good way to get every part on paper, proper there in entrance of your eyes. We’ve bought three steps to set up that budget and two extra to maintain it going—every month.

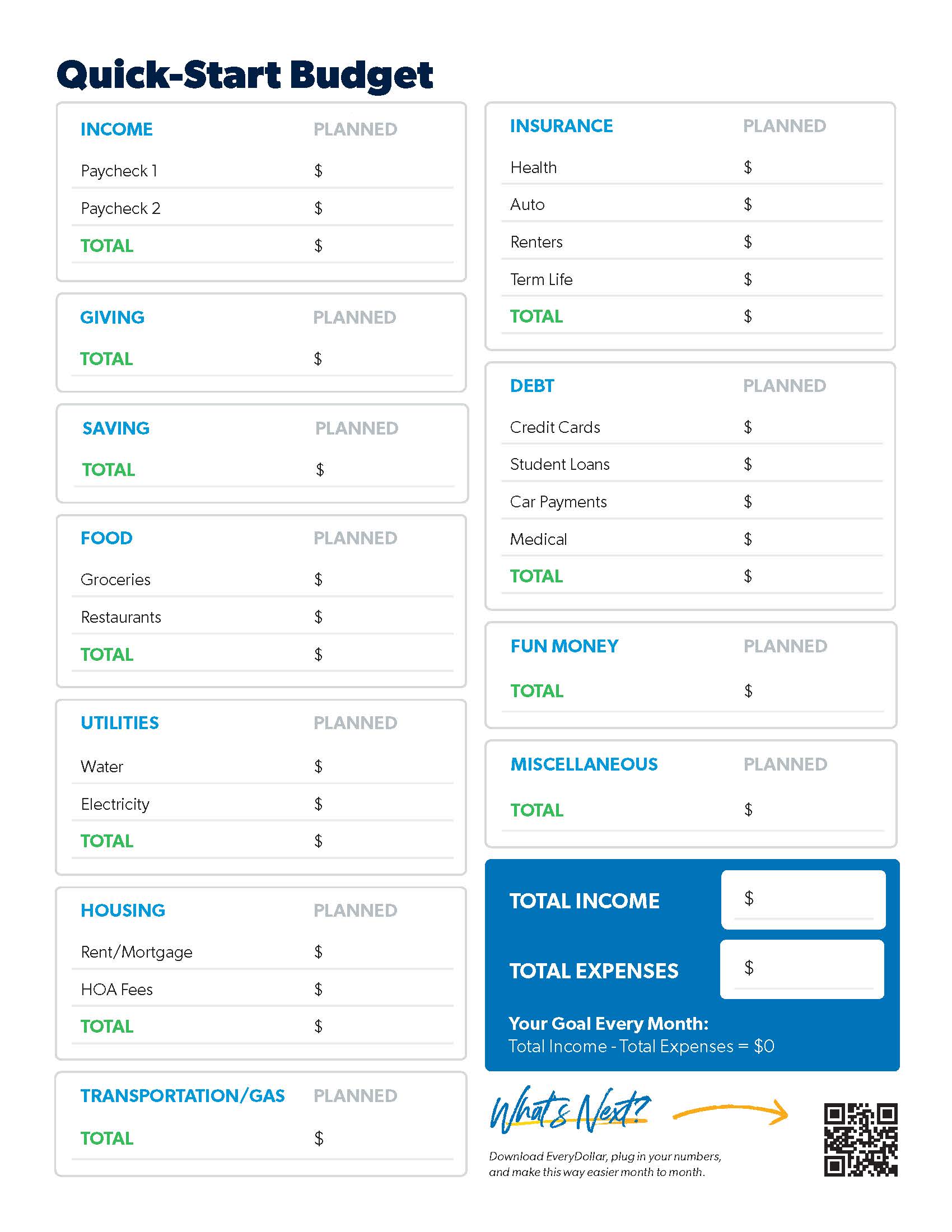

Earlier than you dive in, print out your Quick-Start Budget template and open up your on-line checking account!

Additionally, heads up: We’re about to say the Baby Steps a few instances. That is the confirmed plan to get forward together with your cash—from saving extra to paying off debt to constructing actual wealth.

1. Checklist your earnings.

Do you see the Deliberate column on the high of your Fast-Begin Funds template? That’s the place you record out all the cash that’s coming on this month. Listed here are some fast callouts in terms of this primary step:

- Be sure you write in common paychecks and something additional, like that side hustle money. (Go you!)

- If you happen to’re married, record out all of the earnings for each of you. (It’s fairly romantic, actually.)

- If you happen to’ve bought an irregular income, check out what you’ve made the previous few months and record the lowest quantity as this month’s deliberate earnings price range line. You’ll be able to modify later within the month if you happen to make extra. (We’ve bought a particular irregular income budget template if you happen to want it.)

Now, add all of it up and write in your whole. Now you understand how a lot cash you need to work with this month.

2. Checklist your bills.

Now that you simply’ve deliberate for what’s coming in, you might want to plan for what’s going out: your giving, saving (relying on what Child Step you’re on), and spending.

In relation to all of the month-to-month spending you might want to plan for, you’ll see the price range worksheet goes on this order:

- Four Walls—meals, utilities, housing and transportation

- Different necessities—like insurance coverage and debt

- Extras—like enjoyable cash and that useful miscellaneous line

(You’ve most likely observed your on-line checking account is coming in actual helpful proper now.)

As you’re employed by way of your month-to-month price range template:

- Skip any strains you don’t want.

- Write in something you don’t see a spot for.

- Add the deliberate quantities inside every field.

All proper. What’s subsequent?

3. Subtract bills out of your earnings.

While you do the mathematics in your price range planner sheet, your earnings minus your bills ought to equal zero. We name this the zero-based budget.

No, this doesn’t imply you let your checking account attain zero. Depart a bit of buffer in there of about $100–300.

What it does imply is that you simply’re giving all of your cash a job—paying the payments and transferring you ahead in your money goals. Since you work arduous to your cash, folks. And it ought to work arduous for you. Each. Single. Greenback.

What if you happen to don’t hit zero?

- Acquired cash left over? Um, rejoice. That is nice! Then put these {dollars} towards your present Child Step.

- Acquired a adverse quantity? Pause. Don’t freak out. It’ll be okay. You simply want to cut spending (or increase your income!) till you get to zero.

So, guess what. That’s it for creating the price range. These subsequent two suggestions will enable you to stick to it and make it truly be just right for you.

4. Monitor your transactions (all month lengthy).

How do you keep on high of your spending? Track. Your. Transactions. Meaning you’re monitoring every part that occurs to your cash all month lengthy! That is the way you regulate your progress and maintain from overspending.

5. Make a brand new price range (earlier than the month begins).

Your price range gained’t change an excessive amount of from month to month—however no two months are precisely the identical. So, create a brand new price range each single month. Don’t neglect month-specific expenses (like holidays or seasonal purchases). And do that earlier than the month begins so you may get forward of what’s coming your approach.

To the Funds Template . . . and Past!

Okay, you most likely observed these final two steps aren’t in your month-to-month price range template. As a result of the template is a superb begin. It truly is! It helps you stage up from price range dreamer to price range planner.

Start budgeting with EveryDollar today!

However when you get these first three steps on paper, it’s actually approach simpler to maintain up with all of it if you’ve bought an easy-to-use budgeting app like our private BBFF (budgeting finest pal ceaselessly), EveryDollar. Obtain the app (at no cost!), plug in all these numbers you organized in your price range template, and take your price range with you. In every single place. It’s so a lot better than penciling in each transaction and doing the mathematics your self or rewriting a price range each month. Belief us.

Listed here are three extra useful assets earlier than you go:

Hey, we’re happy with you for budgeting. It’s critically step one to go from the place you might be together with your cash to the place you wish to be. And also you’re going nice locations, one EveryDollar budget at a time!