The U.S. is ready to chop charges—lastly

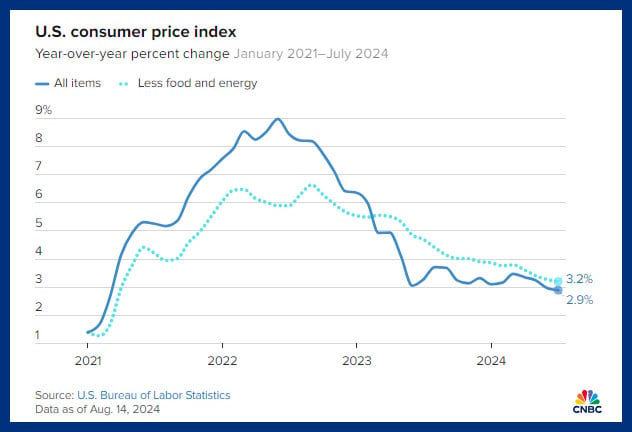

After a lot hypothesis about when the U.S. will lastly start reducing its rates of interest, the CME FedWatch tool reviews a 100% probability that the U.S. Federal Reserve will minimize its charges in September. Market watchers are fairly assured, with a 36% probability that the U.S. Fed will go proper to a 0.50% minimize as an alternative of nudging the speed down. And looking out forward, the futures market predicts a 100% probability of 0.75% in fee cuts by December this 12 months, with a 32% probability of a 1.25% fee lower. The forecasts turned stronger this week because the annualized inflation fee within the U.S. slowed to 2.9%, its lowest fee since March 2021. There are loads of percentages right here, however the gist is persons are anticipating large rate of interest cuts.

These chances ought to take among the foreign money stress off of the Financial institution of Canada (BoC) when it makes its subsequent rate of interest choice on September 4. If the BoC had been to proceed to chop charges at a quicker tempo than the U.S. Fed, the Canadian greenback would considerably depreciate and import-led inflation would doubtless change into a problem.

Listed here are some top-line takeaways from the U.S. Labor Division July CPI report:

- Core CPI (excluding meals and vitality) rose at an annualized inflation fee of three.2%.

- Shelter prices rose 0.4% in a single month and had been chargeable for 90% of the headline inflation improve.

- Meals costs had been up 0.2% from June to July.

- Power costs had been flat from June to July.

- Medical care providers and attire truly deflated by 0.3% and -0.4% respectively.

When mixed with the meagre July jobs report, it’s fairly clear the U.S. consumer-led inflation pressures are receding. Because the U.S. cuts rates of interest and mortgage prices come down, it’s fairly doubtless that shelter prices (the final leg of sturdy inflation) might come down as nicely.

Walmart: “Not projecting a recession”

Regardless of slowing U.S. shopper spending, mega retailers House Depot and Walmart proceed to e book strong earnings.

U.S. retail earnings highlights

Listed here are the outcomes from this week. All numbers under are reported in USD.

Whereas House Depot posted a robust earnings beat on Wednesday, ahead steering was lukewarm, leading to a acquire of 1.60% on the day. Walmart, alternatively, knocked the ball out of the park and raised its ahead steering and booked a acquire of 6.58% on Thursday.

Walmart Chief Monetary Officer John David Rainey told CNBC, “On this setting, it’s accountable or prudent to be slightly bit guarded with the outlook, however we’re not projecting a recession.” He went on so as to add, “We see, amongst our members and prospects, that they continue to be choiceful, discerning, value-seeking, specializing in issues like necessities somewhat than discretionary objects, however importantly, we don’t see any extra fraying of shopper well being.”

Identical-store gross sales for Walmart U.S. had been up 4.2% 12 months over 12 months, and e-commerce gross sales had been up 22%. The mega retailer highlighted its launch of the Bettergoods grocery model as a technique to monetize the development towards cheaper food-at-home choices, and away from quick meals.