Budgeting can really feel like quite a bit at first. And on prime of all of it, there are so many other ways to funds. How do you decide?

Let’s dive into one widespread technique on the market: the 50/30/20 rule. We’ll speak about what it means and the way it works—and see if it’s the easiest way to funds for you.

What Is the 50/30/20 Rule?

What’s the 50/30/20 rule? Properly, this budgeting plan first confirmed up in 2005 in a e-book known as All Your Value. It was initially named the 50/20/30 rule—however you’ll see it known as the 50/30/20 rule extra typically.

This budgeting technique divides your spending and saving into three classes: wants (50%), needs (30%) and financial savings (20%).

50% Wants

Wants in your funds are all of the issues that will majorly have an effect on your life in case you dropped them. Listed below are some examples:

- Meals

- Utilities (like electrical energy, water, pure fuel)

- Shelter (aka mortgage or hire)

- Transportation

- Medical insurance

- Day care

- The minimal funds on all of your money owed

If these issues are in your funds, you want to pay for them—so that they fall into this part.

30% Needs

You guys, learn this fastidiously: Needs aren’t wants.

And everyone knows this—in concept. However after we begin dividing issues into monthly budget classes primarily based on wants versus needs, the traces can get actual fuzzy.

Needs nonetheless have an effect on our lives, however not like wants. We are able to do with out needs (even when it’s uncomfortable).

The 50/30/20 rule says to spend 30% of your take-home pay on the stuff that improves your way of life. This consists of issues like:

- Limitless knowledge plans

- Eating places

- New garments (not as a result of your child outgrew his jacket however since you fell in love with a cute new jacket)

- Sporting events

- Live performance tickets

- Streaming services

Hmm . . . so 30% of your revenue can go to the belongings you need, even in case you’re drowning in debt or have an empty financial savings account? One thing’s off right here.

20% Financial savings

The financial savings class within the 50/30/20 rule covers some tremendous vital elements of your budget:

- Retirement investments

- Emergency fund financial savings

- Any additional debt funds above these minimal funds

That’s simply 20% of your revenue to get you feeling protected and safe with cash for right this moment, tomorrow and down the road in retirement. And also you’re engaged on all three without delay.

Okay, so you possibly can most likely inform by now that I’ve some issues with the this rule. Let’s speak about why.

Professionals and Cons of the 50/30/20 Rule

Professionals

First, what’s useful in regards to the 50/30/20 rule?

Budgeting is a essential behavior.

On the upside, in case you’re utilizing the this rule to funds, effectively, you’re budgeting! You’re making a plan for your money, and that’s so vital.

Beginning factors are useful.

Additionally, the 50/30/20 rule offers you a place to begin that can assist you determine the place your cash goes. While you make your first budget, utilizing a top level view or pointers may help you’re feeling much less overwhelmed. I completely get that.

You’re saving cash.

Our State of Personal Finance study exhibits 34% of Individuals haven’t any financial savings in any respect. So I do recognize that the 50/30/20 rule values constructing that up.

Cons

Prepared to listen to the issues?

It stays the identical.

These three budget percentages keep the identical irrespective of the place you’re in life. Whether or not you’ve got a mountain of pupil mortgage debt otherwise you’re debt-free and investing in retirement, you’re caught with 50/30/20.

Right here’s the deal: You shouldn’t spend 30% of your cash on needs in case you’re in debt, as a result of debt robs this month’s revenue to pay for final month (or final 12 months, even). While you’ve bought debt, it is best to cut down on extras so you possibly can repay the debt and get your revenue again in your management.

Start budgeting with EveryDollar today!

Additionally, the 50/30/20 rule has you plugging alongside slowly on the similar targets on a regular basis. You shouldn’t attempt to hit so many main cash targets without delay!

As a substitute, line up your large cash targets (utilizing the 7 Baby Steps to information you) and knock them down one after the other. You’ll have the ability to actually focus as you save for emergencies, repay debt, and construct your retirement financial savings.

Guess what occurs once you use your funds to take these steps separately as an alternative of struggling to do it unexpectedly, on a regular basis? You. Make. Progress. And that’s what I would like for you—to make progress along with your funds!

Your funds ought to reside and breathe with you. It ought to adapt to your stage of life and to your money goals. The 50/30/20 rule simply doesn’t try this!

It’s manner too centered on needs.

Focusing in your needs retains you from ever getting forward along with your cash. You might need to make sacrifices in your funds proper now, and that’s okay. It’ll all be price it later.

Someday, in case you comply with the 7 Child Steps I simply talked about, you find yourself being so financially safe that you could reside and provides like nobody else.

Don’t field your self into these three numbers ceaselessly. Do the arduous work now so you possibly can spend your cash precisely the way you need later.

Budgets aren’t one-size-fits-all. Your funds ought to replicate your actuality. It ought to replicate the place you’re proper now and the place you need to be along with your cash—not be pressured into some blanket share class. That’ll imply adjusting how a lot you spend on needs at completely different phases of life.

It actually doesn’t work for the common American.

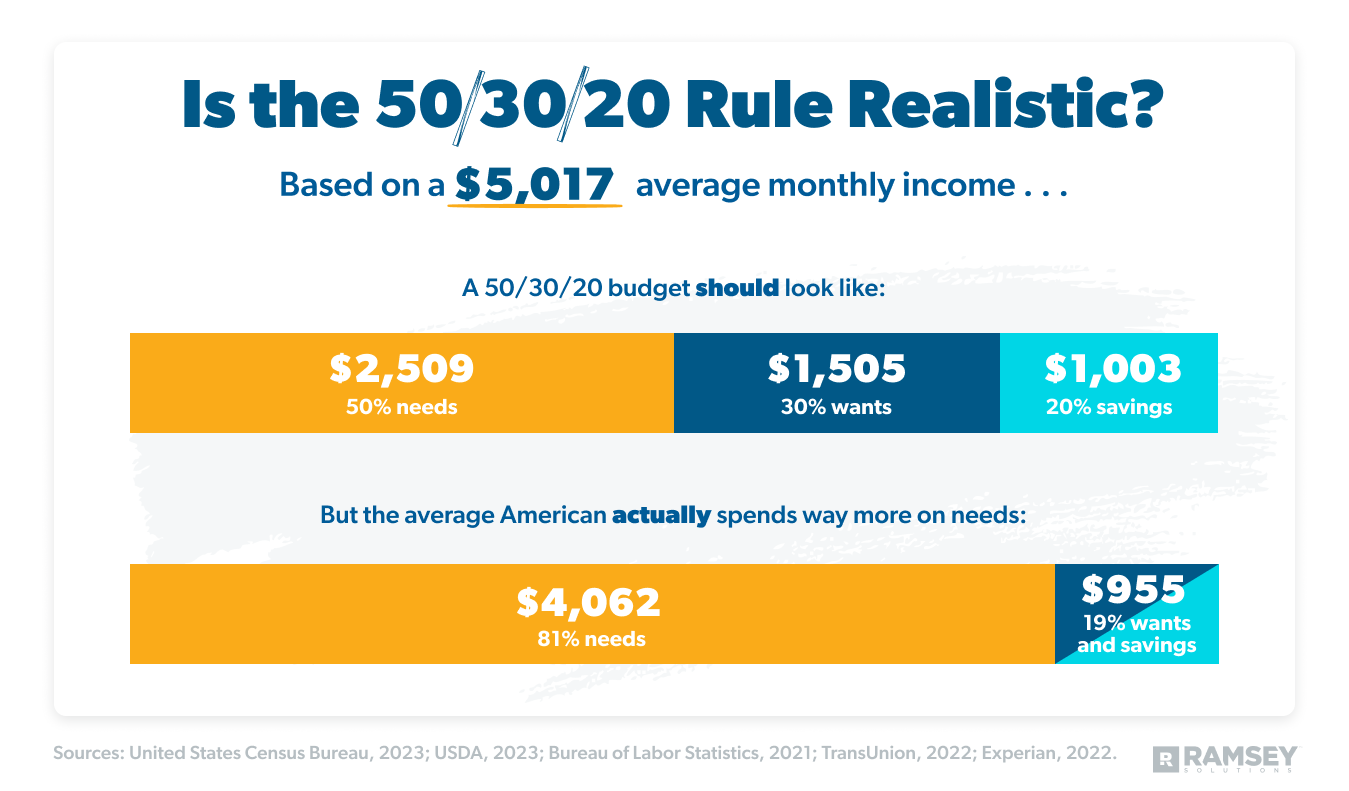

Right here’s the true kicker: In the event you plug in national averages for income and expenses, the 50/30/20 rule doesn’t work. Common wants are extra than 50% of the common revenue.

Critically. Take a look at this math.

First, Earnings

- $74,580 is the median family annual revenue.1

- $5,017 is roughly a family’s month-to-month take-home pay (after taxes, Social Safety and Medicare come out).2

- Breaking that down with the 50/30/20 rule, you’d have $2,509 to spend on wants.

Subsequent, Bills

Let’s speak about frequent bills that may rely as wants and see if these averages add as much as $2,509.

- Common month-to-month groceries for a pair: $6853

- Common month-to-month housing prices:

- Mortgage/hire: $1,885

- Electrical energy: $129

- Water: $58

- Pure fuel: $37

- Home items: $584

- Common month-to-month transportation prices:

- Gasoline: $179

- Upkeep and repairs: $815

- Common month-to-month medical health insurance: $3096

- Common month-to-month bank card debt fee: $116.107

- Common used automotive fee: $5258

Whole common bills: $4,062.10

That’s not 50%. It’s 81%.

In the event you’re a median American with debt, you don’t have 30% left for enjoyable or 20% for financial savings. You can’t use the 50/30/20 rule. And in case you’ve been attempting, you’re most likely annoyed, and also you may be sitting below rising bank card debt as you attempt to sustain with percentages that don’t work in your present life.

While you put the 50/30/20 rule to the take a look at, effectively . . . that math doesn’t add up! Actually.

By the way in which, if this appears to be like something like your scenario, I do know these numbers are uncomfortable. Please know: You aren’t caught right here. It’ll take some work, however you possibly can increase your income, repay that debt, and get far more room within the funds.

However you’ll want a distinct form of budgeting technique.

The 50/30/20 Rule vs. the Zero-Based mostly Price range

What you want is a zero-based funds. What’s that?

A zero-based budget occurs when all of your revenue minus all of your bills equals zero. You give each greenback a job and take management of each penny!

While you’re itemizing out your bills, you begin with giving and your wants. (What I name the Four Walls go first—meals, utilities, shelter and transportation—after which different necessities come subsequent.) After that, you prioritize all the things else within the funds primarily based on your revenue, your scenario and your Child Step.

As issues change in your life, you modify up the place your cash’s going!

And also you do all this inside your versatile zero-based funds (which will get all of your cash working for you) as an alternative of inside a no-budge 50/30/20 rule.

However first, you want a zero-based budgeting device. And I occur to have one to advocate: EveryDollar. That is the budgeting app my household makes use of, and you will get began right this moment. For. Free!

No 50/30/20 for you—no attempting to cram your life and your targets into percentages that severely don’t work. Go all in with the zero-based technique and create a funds that’s actually made for you.