Should you make a month-to-month price range (otherwise you’re prepared to start out), first off—that’s superior. I imply it! Budgeting is step one to taking management of your cash, and also you’re taking that step!

However perhaps you’re questioning when you’ve obtained all the pieces you want in your price range. This might help: a month-to-month bills checklist of prime price range classes. Plus, I’ve obtained some bonus ideas that can assist you price range for these difficult bills that don’t pop up each single month.

Let’s leap proper in.

11 Price range Classes for Every Month

Giving

Saving (or Debt Payoff)

Food

Utilities

Shelter/Housing

Transportation

Insurance

Household Items

Health and Fitness

Fun and Entertainment

Miscellaneous

1. Giving

I at all times begin my household’s price range with giving (10% of our earnings). It’s the easiest way to get my head (and coronary heart) straight earlier than I begin working via the remainder of my price range. Generosity takes the main target off me and shifts it on to occupied with others. And actually, it helps me begin every month feeling far more grateful for what I’ve.

2. Saving (or Debt Payoff)

Emergency Fund

Relying on what Baby Step you’re on, you may have to make saving a precedence. Let’s break that down.

Should you’re in debt, begin by saving a $1,000 starter emergency fund (I name this Baby Step 1). Then pause saving and throw all the pieces further you’ve obtained at paying off that debt with the debt snowball method (aka Child Step 2).

When you’re debt-free, you’ll be in Child Step 3 and saving up 3–6 months of bills in case of a much bigger emergency, like an sudden illness or job loss.

Retirement Financial savings

When your totally funded emergency fund is, effectively, totally funded, it’s time for Child Step 4—retirement financial savings! Begin prepping in your future by investing 15% of your earnings.

Wherever you’re in your Child Steps journey, ensure that your price range aligns with that cash aim. As a result of your price range is step one to creating any Child Step a actuality.

3. Meals

Groceries

Now let’s begin speaking about these month-to-month bills! The primary ones to cowl are what I name the Four Walls—that are the essential requirements that you must survive. These are meals, utilities, shelter and transportation.

And all of it begins with groceries.

Should you’re questioning, the typical household of 4 within the “thrifty” vary spends $975.80 a month on groceries. A thrifty single grownup is spending someplace round $224.50 to $311.30.1 Yeah, inflation has carried out a quantity on meals prices.

Professional tip: Should you’re having hassle taming this price range line, take a look at my free meal planner that can assist you get that quantity down.

Eating places

Okay, folks. That is vital. Be sure that groceries and eating places every have their very own price range strains. As a result of it’s important to eat—however you don’t need to eat out.

That’s proper: Eating places match properly below your meals price range class, however they aren’t a vital and so they aren’t one of many 4 Partitions. If that you must liberate money for one of many Child Steps or get extra margin in your price range, this can be a excellent spot to cut spending and get monetary savings!

4. Utilities

On this month-to-month price range class, embrace all of the companies that preserve your home working:

- Electrical energy

- Water

- Pure fuel or propane

- Trash companies

- Telephone invoice

- Web

Bear in mind, these utility bills may change from month to month, so take into consideration that as you propose.

To be protected, price range on the upper facet in every of those price range strains—and when you don’t find yourself needing the cash, throw the additional at your present Child Step!

Additionally, a few of these aren’t important (like in case your cellphone invoice consists of limitless all the pieces). So once more, if that you must save more money each month, reduce the fluff right here.

5. Shelter/Housing

Simply together with your lease or mortgage cost isn’t sufficient once you price range in your housing costs. Don’t neglect householders insurance coverage and property taxes (in the event that they aren’t already included in your mortgage cost) or renters insurance coverage and HOA charges—if these issues apply to you.

Start budgeting with EveryDollar today!

I do know: It provides up fast! To maintain your housing prices from taking on your price range, preserve these bills to 25% or much less of your take-home pay.

6. Transportation

This price range class may embrace fuel, public transportation prices, routine upkeep, your state’s required auto insurance coverage—actually simply something you’d pay that month to get the place that you must go.

After all, the quantity you price range every month may change up. Take into consideration any particular events like a visit to Grandma’s or an out-of-town soccer event for the youngsters. You’ll have to price range extra for fuel in a month that has extra driving!

Okay, we’re previous giving, saving and the 4 Partitions. The remainder of these month-to-month bills aren’t in an ideal order, however they’re frequent issues folks spend cash on each month. Even when you don’t have a few of these payments, this checklist shall be helpful as you create your own budget.

7. Insurance coverage

Yeah, I do know insurance coverage isn’t enjoyable to spend cash on, however don’t skip this. Insurance coverage helps shield the folks and the belongings you love.

We’ve already talked about residence and auto protection, however once you’re budgeting for month-to-month bills, don’t neglect to incorporate month-to-month premiums for these other insurances you can’t do without:

- Time period life insurance coverage

- Medical health insurance

- Lengthy-term incapacity insurance coverage

- Lengthy-term care insurance coverage (when you’re 60 or older)

- Id theft insurance coverage

- Umbrella coverage (when you’ve obtained a web price of $500,000 or extra)

8. Family Objects

Toothpaste, shampoo, dishwasher detergent, paper towels. They’re not essentially probably the most thrilling issues on this month-to-month bills checklist, however home goods are part of life—and so they should be within the price range.

9. Well being and Health

Medication, nutritional vitamins, dietary supplements, fitness center memberships, exercise apps, remedy—all of it counts right here. Be sure you’re taking good care of your self. However on the similar time, keep in mind: You can be fit and healthy on a budget.

10. Enjoyable and Leisure

Enjoyable (or Private) Cash

Now it’s time for the enjoyable stuff. I would like you to place apart some cash every month to spend on no matter you need. Planning this quantity forward of time helps you spend guilt-free and keep away from overspending on impulse buys.

My husband Winston and I every have our personal enjoyable cash strains—and you must too when you’re married. I don’t need to test in once I see one thing within the $5 Goal bin I would like, so long as there’s nonetheless $5 left in my line! It retains us accountable to our price range and to one another—but it surely additionally offers us freedom to spend. And actually, that’s what budgeting is all about!

Here is an vital callout, although: Should you’re in debt, your enjoyable or private cash shall be fairly small till the debt is gone. But it surely’s only a season, and it’ll be completely price it.

Leisure or Recreation

Tickets to a live performance. A ballgame along with your children. Bowling with pals. It’s nice to spend cash on belongings you get pleasure from—if it’s within the price range! (As a result of you possibly can have loads of enjoyable with out spending a single greenback, .)

Streaming Providers

Should you pay for any TV or music streaming companies to keep away from the advertisements, get these within the price range too! A few of these are a month-to-month expense, in order that they want a price range line each month. Others are a yearly subscription, and we’ll discuss how you can cowl these in a minute.

All of it comes all the way down to this: Whenever you’re budgeting for all of the enjoyable stuff, don’t let FOMO take over and tempt you to say sure to all of the issues. Your money goals are too vital for that. Plan how a lot you possibly can spend every month on all these extras. After which persist with it.

11. Miscellaneous

The last-minute goody baggage for a faculty celebration. The haircut appointment you forgot about. All these forgotten extras gained’t ship you into panic mode as a result of you possibly can simply slip them into your miscellaneous class. But when a sure expense retains falling right here, it’s time to offer it a particular price range line all its personal.

Simply Forgotten Month-to-month Bills Listing

When does the Amazon Prime membership renew? What concerning the automobile tag renewal? And when is your pet’s annual checkup?

Though these bills solely pop up each from time to time, you don’t need them to shock you and throw off your month-to-month price range.

So, take a while to replace your calendar with any renewal or appointment dates. Then look at your calendar once you make your price range! (Additionally, when you’ve obtained our free budgeting app, EveryDollar, you possibly can at all times peek again ultimately yr earlier than you make every month-to-month price range!)

Listed here are a number of forgotten or neglected bills to consider:

1. Pest Management

Whether or not it’s as soon as 1 / 4 or annually, name within the professionals or do a DIY job to get your private home protected against termites and pests.

2. Group Dues

Should you’re in a membership that has annual membership charges or your children are in sports activities, don’t get blindsided by these seasonal bills! Get them within the price range.

3. Annual Checkups and Copays

No quantity of laughing fuel will ease the ache of an unbudgeted dental cleansing. And for these annual checkups or specialist appointments, don’t neglect to price range for the copays!

4. House Upkeep

House bills don’t cease at utilities and mortgages. Don’t neglect the stuff like gutter cleansing and HVAC inspections. Some bills you possibly can plan for. So be budget-ready for these. And for the whole surprises, effectively, that’s what your emergency fund is for!

5. Particular Events and Presents

Shock events are enjoyable, however not when it’s, “Shock! It’s your anniversary!”

Be sure you’ve obtained all these upcoming holidays, birthdays, weddings, child showers and all different particular events in your price range. Possibly simply have a month-to-month present line. That method, you’ll at all times have cash prepared for presents. Additionally, don’t neglect your anniversary. Simply don’t.

6. Taxes

It’s everyone’s favourite factor—taxes! Okay, I’m joking. However they nonetheless occur. Each single yr.

Should you’re a enterprise proprietor or freelancer, or when you’re working a facet hustle, don’t let taxes sneak up on you. And don’t neglect to price range in your tax pro’s services or in your tax filing software when it comes time to file.

7. Annual Subscriptions and Memberships

These big-ticket subscriptions and memberships that come out yearly (and even quarterly)—be sure to’ve obtained them lined too!

For any of those simply forgotten price range classes you possibly can:

- Use that miscellaneous line

- Arrange a sinking fund to avoid wasting slightly every month for a large expense

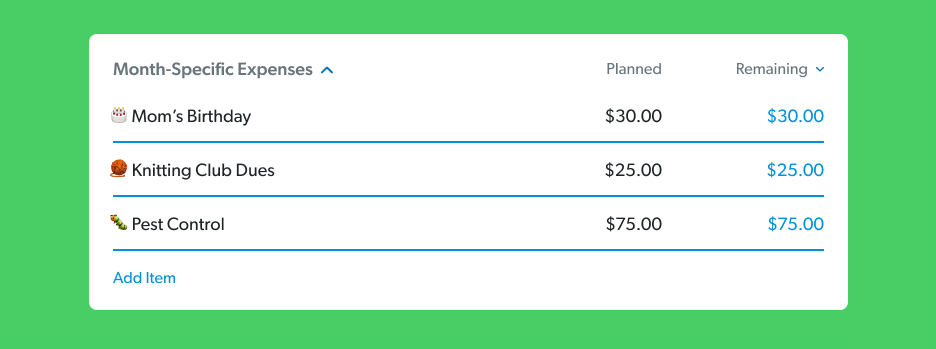

- Create a month-specific price range class that stays in your price range at all times—simply change out the price range strains below it that can assist you cowl no matter wants you have got that month (see beneath)

And keep in mind: Don’t use your emergency fund, unless it’s an actual emergency. Interval.

Tips on how to Price range Your Month-to-month Bills

So, that’s an outline of what your month-to-month bills could possibly be. Now that you must know how you can create your monthly budget!

Step 1: Write down all of your earnings in a typical month. (When you have an irregular income, put in your lowest estimate. You may bump it up later when you make extra!)

Step 2: Make an inventory of all of your month-to-month bills (sure, even the simply forgotten ones).

Step 3: Subtract your bills out of your earnings—and that quantity ought to equal zero. This methodology is named zero-based budgeting.

Now, a zero-based price range doesn’t imply you have got zero {dollars} in your checking account. (Preserve slightly buffer of $100–$300 in there.) It additionally doesn’t imply you spend all the pieces you make.

Nope. It merely means you’re giving all of your cash a job to do. It means you propose the way you give, save, spend and make investments all your earnings. This fashion you by no means get to the tip of the month and marvel the place all of your cash went— you know.

Whenever you price range, you are accountable for the place each single greenback goes. This offers you confidence that you simply’re spending and saving effectively.

By the best way, when you don’t have a budgeting app but, attempt EveryDollar! It’s how my household makes our month-to-month price range, and you may get began at no cost.

And keep in mind, you’re the one answerable for your cash, and you can also make all of your cash objectives a actuality—one month-to-month price range at a time!